Legacy Bank offers you the resources to help you manage your money efficiently. It does not matter if your company is a retail business, a professional practice, a mining company or a non-profit organization, we will help you save time and money.

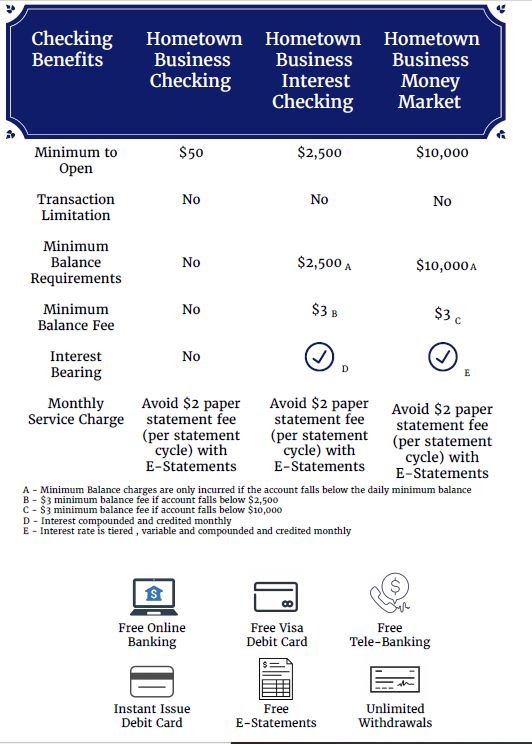

You may want both of our business accounts. One for your day-to-day expenses and the other to earn interest on funds that you may not immediately need. Come in and open a business account today.