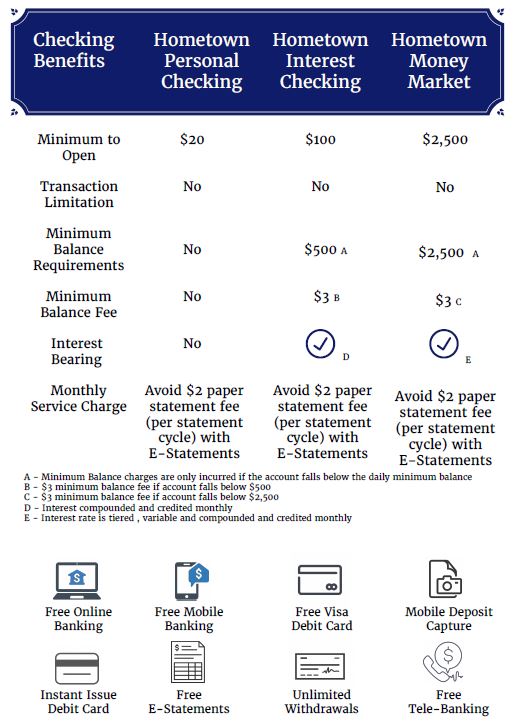

Legacy Bank offers a choice of checking accounts. Read through our selection of accounts and decide which fits you best. We have no fees checking and checking accounts with accidental life insurance attached.

Check out our hometown checking products below: